Resource information

Microfinance institutions (MFIs) in Ethiopia are offering farmers a new financial product: the SLLC-linked individual loan product

With Second Level Land Certification (SLLC), MFIs have the security of knowing the ownership and exact landholding size of farmers. This has allowed the development of an innovative individual lending product that uses the produce of the land as a form of guarantee.

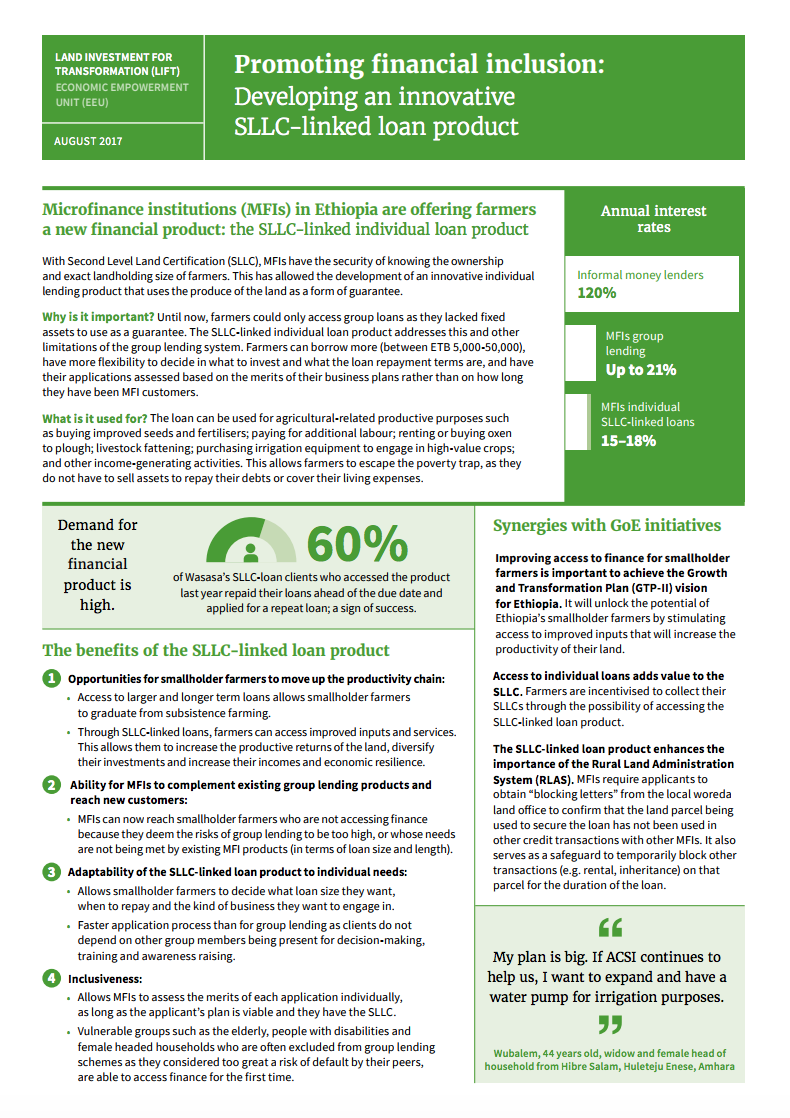

Why is it important? Until now, farmers could only access group loans as they lacked fixed assets to use as a guarantee. The SLLC-linked individual loan product addresses this and other limitations of the group lending system. Farmers can borrow more (between ETB 5,000-50,000), have more flexibility to decide in what to invest and what the loan repayment terms are, and have their applications assessed based on the merits of their business plans rather than on how long they have been MFI customers.

What is it used for? The loan can be used for agricultural-related productive purposes such as buying improved seeds and fertilisers; paying for additional labour; renting or buying oxen to plough; livestock fattening; purchasing irrigation equipment to engage in high-value crops; and other income-generating activities. This allows farmers to escape the poverty trap, as they do not have to sell assets to repay their debts or cover their living expenses.