What happens when the soy and palm oil boom ends?

By: Rhett A. Butler

Date: 21 February 2017

Source: Mongabay

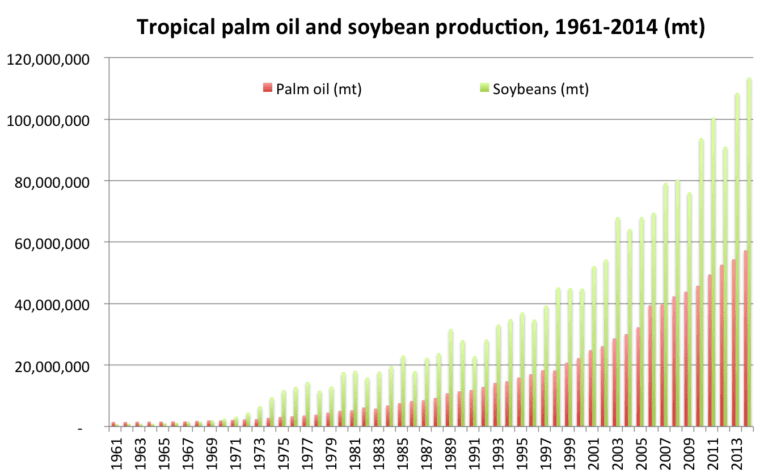

Over the past thirty years demand and production of oils crops like oil palm and soybeans has boomed across the tropics thanks to rising incomes, macroeconomic changes and government policies, and substitution effects. This rapid expansion has in some places taken a heavy toll on native, wildlife-rich ecosystems—especially rainforests, wetlands, and savannas—while exacerbating conflicts over land. As a result, this growth has at times perplexed and dismayed ecologists, environmentalists, and human rights advocates.

However there are signs that the bonanza may slow as it evolves in response to changing conditions including slackening demand, higher transactions coforeststs for securing land, and productivity gains, argues The Tropical Oil Crop Revolution, a new book by Stanford University researchers Derek Byerlee, Walter P. Falcon, and Rosamond L. Naylor.

Published in October 2016 by Oxford University Press, The Tropical Oil Crop Revolution chronicles the rise of the tropical oil crops, evaluates the costs and benefits of the industry, and makes projections for what the authors call “the world’s most dynamic agricultural sector in recent decades.”

Byerlee discussed the book and its findings during a February 2017 interview with Mongabay.com.

AN INTERVIEW WITH DEREK BYERLEE

Mongabay.com: What is your background and what led you to write this book?

Derek Byerlee: I am an agricultural economist with a career in academia, international agricultural research and the World Bank where I directed the World Development Report 2008 on Agriculture. I then joined the Center on Food Security and the Environment at Stanford University where I worked on the twin issues of land use changes in the tropics and large-scale investments in farming. The surge in oil crops, notably soybeans and oil palm, was clearly the major driver of both phenomena as recognized by many environmentalists. However, the major supply and demand drivers of the global edible oil markets were poorly analyzed. With colleagues at Stanford University, Professors Rosamond Naylor and Walter Falcon, we felt there was a gap that we could fill. Stanford University has had a long history of undertaking commodity studies and in fact, carried out a series of detailed studies on fats and oils in the 1920s.

Mongabay.com: What are the biggest factors behind the surge in tropical oil crop production?

Derek Byerlee: A host of factors aligned on the demand and supply sides to produce a “perfect storm” for growth of tropical oil crops.

First and foremost, demand expanded rapidly for both protein meal and vegetable oils. As consumers in emerging economies became richer, they greatly increased their consumption of livestock products and the associated demand for protein meal for feed, as well as for vegetable oils for cooking and processed foods.

Second, the rising demand for vegetable oils was further fueled—both literally and figuratively—when the biodiesel industry took off. This industry, driven by policies mandating the use of biodiesel as a transportation fuel in several countries, has accounted for about one-third of the increase in global vegetable oil demand since 2003.

Third, on the supply side, cheap land in Brazil became accessible with the construction of new highways and ports, and new technologies allowed soybeans to grow well in the tropics. In Southeast Asia, even cheaper land became available for oil palm as governments made large concessions of forested and degraded land available to private companies. In addition, the era of market liberalization and privatization starting in the late 1980s brought a surge of private capital, often foreign, to develop new supply chains, especially during the commodity boom from 2007-14. Cheap credit, often subsidized, was also available to the oil crop sector through national development banks. Easy access to land and capital, along with the availability of productive technologies, made oil crops very profitable and promoted their expansion.

Fourth, global trade liberalization and integration under WTO stimulated trade in edible oils that linked producers in a handful of exporting countries to distant consumers at a relatively low cost. The most dramatic changes occurred in China and India. China’s liberalization of soybean imports made it by far the world’s largest importer of soybeans (mostly supplied by Brazil), and India’s liberalization of vegetable oil imports made it the world’s largest importer of vegetable oils (largely supplied by Indonesia).

Finally, the extraordinary growth of the two dominant oil crops, oil palm and soybeans, came from massive substitution of their products for traditional sources of vegetable oil. For example, palm oil replaced virtually all of the coconut oil used in food in Indonesia and soybean meal replaced waste materials and by-products in animal feed in China.

Mongabay.com: What are your expectations in terms of demand for 2050? (e.g. including animal feed and biofuels)

Derek Byerlee: We differ with many who predict continuation of the rapid growth of the past two decades (for example, a Mongabay article on soybeans on Feb 9). For a number of reasons, our analysis sees growth in demand for tropical oil crops sharply slowing by 2050 (by as much as two-thirds).

First, growth in demand for biofuel feedstocks cannot maintain the rapid pace of the past decade. This tapering off will be most apparent in the EU, the major consumer of biodiesel today, especially as it approaches the regulated maximum of renewable transport fuels that can be provided from foodstuffs. Some tropical countries, notably Brazil and Indonesia, may compensate only partly for the EU slowdown, but in our view neither India, China (the two most populous countries) nor sub-Saharan Africa will become significant producers of biodiesel, given their high dependency on imported vegetable oils.

Second, the use of vegetable oils for food will also grow more slowly than in the recent past – in Asia, population growth will be slower and the effects of rising incomes will diminish as consumers in middle-income countries have already reach high levels of vegetable oil consumption. Likewise, the use of protein meal for animal feed is subject to a similar slowdown as China’s meat consumption levels-off.

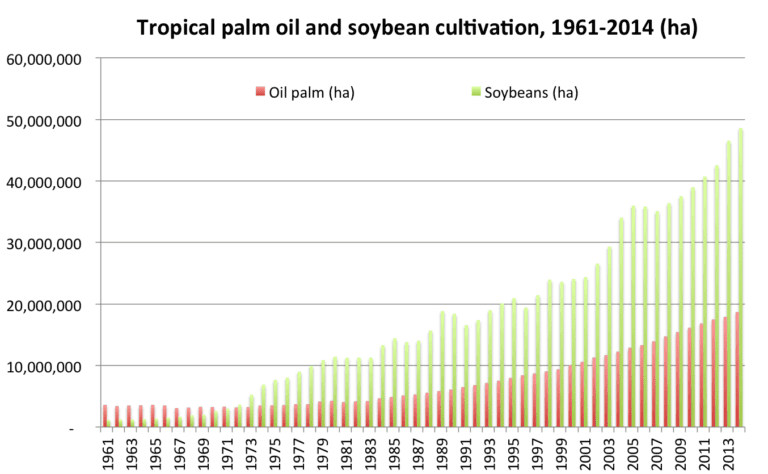

Third, on the supply side, the transactions costs of assessing large tracts of land is increasing as environmental regulations tighten and current users gain more secure rights to their land. Our analysis also indicates that the area covered by oil crops does not have to expand greatly to meet future demand, which can be supplied largely through intensification of existing crop land through steady genetic gains in yields and closing yield gaps.

Mongabay.com: And what sort of impact would you expect that to have on native ecosystems like tropical forests, woodlands, and savannas?

Derek Byerlee: Obviously, the sharp slowing of demand and land requirements will reduce the pressure on native ecosystems. Better land and forest governance has already minimized the area deforested to produce soybeans and the major challenge now is to better manage expansion on the savannahs of Latin America and increasingly Africa, whose valuable ecosystem services have been underappreciated. In the case of oil palm, sufficient degraded land is available to accommodate area expansion, provided land governance and incentive systems can be developed to steer the expansion onto degraded lands and away from areas of natural vegetation with high carbon stocks and biodiversity values.

Mongabay.com: Do you think mechanisms like the Amazon soy moratorium and zero deforestation commitments from oil palm growers will be effective in pushing expansion to less sensitive areas?

Derek Byerlee: We are cautiously optimistic on these initiatives. The soy moratorium has already minimized the area planted on forests. More research is needed to understand secondary effects of replacing pastures with soybeans, given that cattle ranching is now the major driver of deforestation in the Brazilian Amazon. The zero deforestation commitment by big traders of palm oil is a major breakthrough but challenging to implement given poor forest governance in frontier areas (e.g., in Kalimantan and Papua in Indonesia and Cameroon), and the complexity of palm oil supply chains. However, new technologies for supply chain management and real-time monitoring of deforestation improve the chances for success.

Mongabay.com: There’s been a lot of talk about central and west Africa becoming a major area of expansion for industrial oil palm, yet to date commercial oil palm development in the region is lagging far behind the hype. What are your expectations for the region and will oil palm be challenged by issues indigenous crops often face in their native lands when they are grown as monocultures?

Derek Byerlee: The fastest growth in food consumption of edible oils will be in Africa. West and Central Africa have gone from being the world’s major exporter in the 1960s to becoming a significant importer. The small-scale semi-artisanal sector that produces red palm oil for local diets is a major source of livelihoods. However, it is no longer a player in world markets and is falling behind in meeting the burgeoning demand for refined oil for processed foods for urban markets. There is a long history since the early 1900s of promoting oil palm plantations in the region with very modest success. Recent experience has not been encouraging in countries such as Liberia due to weak land tenure security. We advocate a judicious combination of improvements in the local supply chains of smallholders and small-scale processors with injections of outside capital, technology, and market expertise through private investors. The current emphasis on investment in large plantations is unlikely to be sustainable, given the complexities of African land markets and land rights.

Mongabay.com: Oil palm has increased smallholder livelihoods in many parts of the world. Are there opportunities for other oil crops like soy to act as a catalyst for smallholder incomes?

Derek Byerlee: Yes, there is growing evidence of the role of oil palm – especially the two million or more smallholders – in reducing poverty in Indonesia. One of the little known success stories has been the expansion of soybeans in India becoming the world’s fourth largest in terms of area, entirely by small and very poor farmers. There are now local successes with soybeans in Southern Africa that could with appropriate support develop into major new income sources for the small farmers of the region.

Mongabay.com: One of the big challenges in places for oil palm in places like Indonesia is smallholder productivity. Do you see much progress in improving smallholder yields and getting better genetic material to rural communities?

Derek Byerlee: Smallholder yields on average in Indonesia are about 85% of plantations but that includes a substantial outgrower segment associated with plantations. Improving yields of independent growers is the major challenge, starting with good genetic materials. We don’t see this as an insurmountable problem and there is much experience on how to do this from other tree crops that were formerly grown mostly on large plantations. The two leading tea exporters, Kenya and Sri Lanka, have largely converted from plantations to smallholders over the past 30 years and yield gaps are now small. Likewise, Thailand the second biggest rubber exporter, has achieved over 80% adoption of clonal rubber and the highest yields of any major producer, exclusively through smallholders. Well-run parastatals supported by a small levy on exports in Sri Lanka and Thailand and a smallholder-owned tea development company in Kenya have made these successes possible.

Mongabay.com: Do you foresee any major substitutes on the horizon — like algae or fungi — that could curb or reverse tropical oil crop expansion?

Derek Byerlee: We looked at this and decided that the production of edible oils from algae or other means is a long way in the future. However, second generation biofuels if successful could sharply curtail demand for vegetable oils.

Mongabay.com: How does climate change factor into potential expansion in coming decades?

Derek Byerlee: We did not explicitly look at the effect of climate change on yields as it would have to be done in the context of the global markets for edible oils. The most likely scenario is that temperate countries with a lot of land such as Russia and Ukraine would capture a greater share of the market for edible oils relative to oil palm that would be negatively affected by and longer and hotter dry season.

The Tropical Oil Crop Revolution: Food, Feed, Fuel, and Forests by Derek Byerlee, Walter P. Falcon, and Rosamond L. Naylor. Published: 07 November 2016.

Source

Language of the news reported

Related content:

Copyright © Source (mentioned above). All rights reserved. The Land Portal distributes materials without the copyright owner’s permission based on the “fair use” doctrine of copyright, meaning that we post news articles for non-commercial, informative purposes. If you are the owner of the article or report and would like it to be removed, please contact us at hello@landportal.info and we will remove the posting immediately.

Various news items related to land governance are posted on the Land Portal every day by the Land Portal users, from various sources, such as news organizations and other institutions and individuals, representing a diversity of positions on every topic. The copyright lies with the source of the article; the Land Portal Foundation does not have the legal right to edit or correct the article, nor does the Foundation endorse its content. To make corrections or ask for permission to republish or other authorized use of this material, please contact the copyright holder.